Kyle Turner: The Rabbitohs legend who never forgot his roots

What is a tenant ledger and why it matters in Australia

In the Australian rental market, staying on top of financial records is essential for both tenants and landlords. One of the most important documents that helps achieve this is a tenant ledger. Whether you’re renting a studio apartment in Sydney, managing an investment property in Melbourne, or overseeing a rental portfolio in Perth, understanding how a tenant ledger works can make all the difference.

This article explains what is a tenant ledger, why it’s so important, what details it includes, and how it can benefit tenants, landlords, and property managers alike.

What is a tenant ledger?

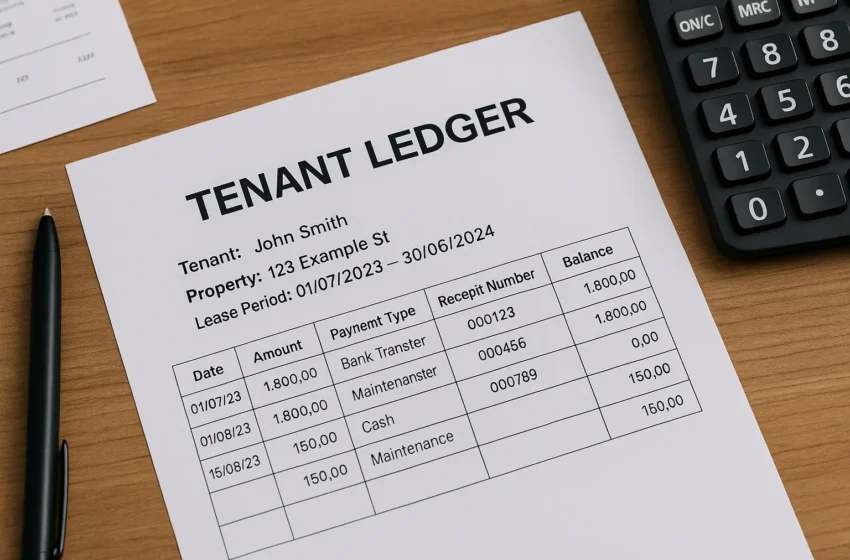

AA tenant ledger, sometimes referred to as a rental or lease ledger, is a formal record that outlines every payment a tenant has made during the duration of their tenancy. This includes rent payments, security deposits, utility charges, and any other associated fees. Traditionally maintained as physical documents, most tenant ledgers are now stored electronically using property management software, making them easily accessible for both landlords and tenants .

What information does a tenant ledger include?

A well-kept tenant ledger contains several key details that provide a full financial overview of the tenancy:

- Tenant’s name and contact details

- Address of the rental property

- Rental payment schedule (weekly, fortnightly, monthly)

- Start and end dates of the lease

- Dates and amounts of each payment made

- Method of payment (bank transfer, cash, etc.)

- Breakdown of charges (rent, utilities, maintenance, etc.)

- Any late payments or outstanding amounts

- Running balance (what’s paid vs. what’s due)

- Receipt numbers or references for payments

This document is typically updated by the property manager or landlord using property management software.

Why is a tenant ledger important?

Effective rental management relies heavily on both landlords and tenants actively using the tenant ledger to track payments and responsibilities. Here’s why:

1. Track rental payments

The record maintains a detailed payment history, helping both parties verify rent payments and track outstanding balances.

2. Proof of rental history

The tenant ledger serves as a trustworthy record of every rent payment made over time. Approval of a tenant ledger becomes necessary to obtain rental properties or to secure a home loan.

3. Assists in dispute resolution

A tenant ledger serves as a piece of documentary evidence to resolve payment disagreements and rent disputes promptly through its factual payment records.

4. Supports financial planning

The ledger enables tenants to plan their budget and inspect their financial expenses. Through a tenant ledger, landlords achieve better management of rental finances along with better capability to plan future lease rate adjustments.

5. Compliance with tenancy laws

Landlords are, under Australian law as well as other jurisdictions, required to maintain precise records showing rental payments made by their tenants. Tenants can use a ledger to show compliance with required tenancy regulations.

How to read a tenant ledger

Rental transactions appear chronologically in the tenant ledger to track every recorded financial activity of rentals. The record maintains a detailed payment history, helping both parties verify rent payments and track outstanding balances.

The Amount Paid section contains tenant payments, whereas the Balance Due section displays the remaining amount owed. The specified payment information allows tenants and landlords to monitor rental transactions so they can track payments and uncover payment problems with ease.

When is a tenant ledger needed?

A tenant ledger must exist during three main situations:

- During property rental applications, rental ledgers serve as proof of reliability for prospective tenants who want to rent from landlords or managers.

- When seeking a home loan from financial institutions, they require applicants to present their rental payment history to assess financial reliability.

- The document provides evidence for rent disputes because it shows proof of payment records.

- Rental property audits and tax reporting require landlords to use ledger records to track rental payments and prepare tax filings.

How to request a tenant ledger

Tenants possess the right to ask for their rental ledger documentation through communication with either their property manager or landlord. The rental ledger must be available to tenants in Australia, so landlords must provide it when requested. Typically, a tenant should:

- Start by contacting the property manager via email or written request to obtain the ledger.

- State the duration requirement by clearly defining the length of history you need, either for particular time spans within the rental period or all of it.

- Follow-ups through phone or email become necessary when there are delays in obtaining the document, since they can help speed up the process.

Digital vs manual tenant ledgers

Modern property management software has made it easier to maintain and access tenant ledgers. While some landlords still use manual records, digital ledgers offer several advantages:

- Real-time updates: Tenants have easy online access to their complete payment records.

- Easy access: Tenants and landlords can retrieve records instantly.

Popular property management platforms in Australia, such as PropertyMe, Console Cloud, and Re-Leased, offer automated tenant ledgers that simplify rental transactions.

Is a tenant ledger the same as a rental receipt?

Not exactly. While both track rental payments, a rental receipt is issued per individual payment. In contrast, a tenant ledger is a comprehensive log of all financial activity during the tenancy. It’s more complete and usually preferred in formal applications or legal situations.

Conclusion

A tenant ledger is an essential document in all rental agreements, ensuring transparent transaction records. A tenant ledger helps all parties maintain payment records, resolve disputes, and comply with tenancy laws. A proper tenant ledger serves as a critical tool for both tenants who need rental history documentation and landlords who must handle various properties because it maintains the stability of their rental operations.

Diving into the workings of a tenant ledger, along with its financial value, allows users to maintain better rental finances and reduce their rental challenges.